What is a Sell Stop Order

John Lee Rossi

Updated 02 February 2021

John Lee Rossi

Updated 02 February 2021

- Sell stop is a pending order to open a sell position at a lower price than the current market price

- Sell stop is always a pending order until filled or cancelled

- If filled, the sell stop order becomes a market order

- Sell stop orders can also be set with SL and TP levels

Table of Contents

What is a Sell Stop Order

A sell stop order is a pending order to enter a short position on a security at a specified lower price. Sell stop is a pending order used on a market trending down and it’s placed below the current market price.

A sell stop order is part of the pending orders class, where an order is placed on a broker’s platform an remains inactive until filled. Only when it becomes filled the sell stop order becomes a market order.

Sell stop orders can be placed on several financial instruments, such as Forex and cryptocurrencies CFDs. Sell stop orders can be set with time parameters, with an expiry date and time, or GTC (Good till Cancelled).

A sell stop order with an expiry date will be removed from the broker’s order book, if it’s not filled by the set time. If a sell stop order is set as GTC, it will remain open on the broker’s order book until it gets filled or is manually cancelled.

Sell stop orders are a great resource for traders wanting to enter the market, but without time to check the charts constantly. By setting a pending sell stop order, traders will be sure to enter the market, even if they are logged off their trading platform, or even if they are asleep.

On the MT4 and MT5 trading platforms, pending sell stop orders can also be set in conjunction with two other pending orders; stop-loss and take-profit.

This powerful combination of sell stop, stop-loss and take-profit pending orders, due to its versality, are widely used by scalpers and by day traders expecting market price breakouts.

How to Place a Sell Stop Order on MetaTrader Desktop

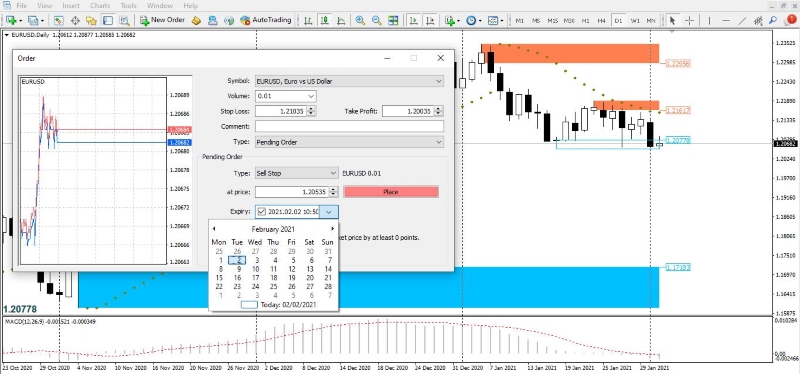

Sell stop orders can be placed on MetaTrader 4 and 5 desktop versions by selecting “New Order” from the navigation tab. When the trading terminal display opens up, find the fifth option, which by default is set to “Market Execution”, click the arrow on the right once and select “Pending Order”.

The bottom half of the trading terminal display will change from instant market execution orders, with a red sell by market and a blue sell by market buttons, to “Type”. By clicking the right arrow of this menu, you will see the four market pending orders available, including sell stop order.

Select the sell stop order type, fill in the “at price” field, set the lot size, set an order expiry, set a stop-loss and a take-profit level if you wish. The sell buttons on the MetaTrader platforms, in order to be easily identifiable, are always red.

After setting all the parameters on the pending sell stop order, press the “Place” button (it will be in red colour). As mentioned before, if you didn’t set any expiry parameters for your order, then the sell stop will remain open until filled by the broker or if you cancel it manually.

How to Place a Sell Stop Order on MetaTrader Mobile

It is also possible to set sell stop orders, if you trade on the go, via your Android or iOS phone, and these orders have the same features of the sell stop orders of the MetaTrader Desktop version.

To place a sell stop order on MetaTrader Mobile, open the order terminal by touching the top right symbol that looks like a page with a “+”. The first order type that appears is the “Market Execution”, and by touching it MT4 mobile will display the four pending order types, including the sell stop order.

Select “Sell Stop”, and set all the parameters. You can select the lot size, set the sell stop price, set or not a stop-loss and take-profit level and the order expiration. When you’re ready and if you have set a correct sell stop price, touch the, now unblocked, “Place” button at the bottom of the screen.

How to Cancel a Sell Stop Order on MetaTrader Desktop and Mobile

To cancel a pending sell stop order on MT4 just maximise (if it was minimised) the “Trade” tab. You will see all the current open orders, if applicable, and on the bottom half, on the “Type” column, you will find the pending sell stop orders.

To cancel the sell stop order, without any delays, just follow the row to the right and find the grey “x”. Press that and the sell stop order will be cancelled straight away.

To cancel a sell stop order on MetaTrader Mobile, open the “Trade” tab on your mobile terminal. You will see all the open orders, if applicable, on the “Positions” divider and right below it, on the “Orders” divider, the sell stop orders.

Select the sell stop order you wish to cancel, by long pressing it. A new popup will open with 3 options. Select the second option “Delete order”, and the sell stop order will be cancelled from the broker’s book instantly.

When Should Traders Use a Sell Stop Order?

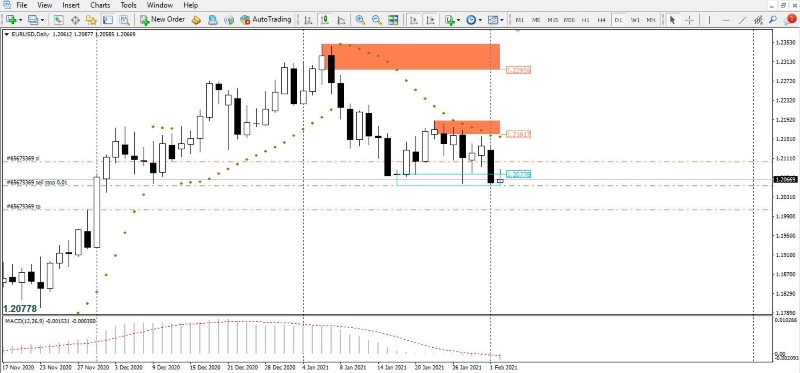

Sell stop orders are a great tool for traders trading breakouts on bearish trends. Different types of traders use the sell stop orders to make a profit, particularly the day traders using support/resistance strategies and traders using pivot points strategies.

The sell stop order can be used on an downward trend, by placing a pending order in advance to enter the market when the price breaks a particular level (last low, or a support level), ensuring a greater probability of achieving a predetermined entry price.

For example, a trader using the pivot point strategy can place one, or several, pending sell stop orders across all the support levels (S1, S2, and so) below the pivot point, hoping for a price breakout below these levels.

In this case, we will recommend a sell stop order with an adequate, protective, stop-loss to protect the order against any unforeseen or sharp price retracements.

Sell stop orders are also a viable option for traders using a support/resistance strategy, by placing a pending order, triggered after the break of a strong support level during a downtrend.

Conclusion

Sell stop orders are an excellent way to free traders from constantly monitoring a security’s price, especially for those who follow the price action of multiple instruments.

Contrarily to the sell limit order, that can be deployed on the stock markets (if they allow for short selling), the sell stop order cannot be used in this market for placing a pending sell at the breakout of a support level.

About the author: John Lee Rossi

John Lee Rossi, currently head of fundamental and technical research with Clear Markets Ltd., is a seasoned trader with more than 16 years experience trading in the financial markets. John previously worked for several brokerage companies, operating in different OTC markets, specialising in a wide range of financial products, from Forex trading to commodities trading. Happily married to his lovely wife Frances, John has two teenage daughters. Away from the business, he enjoys hiking, golfing, and spending time at the Ozarks lake with family and friends.

John Lee Rossi, currently head of fundamental and technical research with Clear Markets Ltd., is a seasoned trader with more than 16 years experience trading in the financial markets. John previously worked for several brokerage companies, operating in different OTC markets, specialising in a wide range of financial products, from Forex trading to commodities trading. Happily married to his lovely wife Frances, John has two teenage daughters. Away from the business, he enjoys hiking, golfing, and spending time at the Ozarks lake with family and friends.